August 16, 2021 marked a special, special day for foreigners living, working, and integrating more into Chinese society. 'Twas the day a special regulation in Shanghai labor law that excluded foreign employees from paying into the national social security system expired. Technically, starting from last Monday, just like their Chinese colleagues, foreign professionals living in China now have to pay into the "five pillars of China's social security system:" Retirement Pension, Health Insurance, Work-Related Injury Insurance, Unemployment Insurance and Maternity Compensation.

The immediate significance to employers is this: It is now more expensive for companies in China to employ foreign nationals. They can: a) negotiate your salary as a net sum and pay this extra cost themselves, assuming the extra financial burden or; b) transfer a portion of this cost to the employee, reducing their overall take-home salary and incentive.

The immediate significance to employees is this: in the case of a) your salary is unchanged, although you're probably going to be having a discussion with your HR; or b) your salary will be reduced. In both cases, moving forward, the next job you have, this Social Security Fee will be part of the discussion.

This comes on the heels of the recent changes to the applicable tax laws foreign professionals now face in China. For an extended look at that, check out this article right here.

Why is everyone talking about this right now ?

Let's take a step back and look at the history. Before 2009, foreigners were excluded entirely from China's social security system. Even if you wanted to, there was no legal framework in place to include you in the social security system. In November 2009, the Shanghai city government issued an order that would make it possible for foreigner employees to voluntarily participate in some elements of the social security system: You could get pension, medical insurance, and industrial injury insurance. This was "local circular No. 38", and aimed at foreign nationals looking for the partial protection this government program could provide.

Then, two years later, on November 15, 2011, a new nationwide law was issued by the Ministry of Human Resources that required all foreigners who are legally employed in China to participate in the system.

That's when the situation started being unclear, or as they like to say, a "gray area" was created. The nationwide law required foreign employees to participate, however, the Shanghai-specific circular still existed and declared it to be voluntarily. Usually, nationwide laws would trump provincial or city-wide regulations. The reality in Shanghai, however, was that local authorities never enforced it.

This might have changed last Monday because apparently the Shanghai-specific law — "Circular No. 38" — had an expiry date: August 15, 2021. From that day, the social security obligations of foreigners and people from Taiwan, Hong Kong, and Macao have all returned to the purview of the national regulations.

Wait, so does this mean employees and companies will have to pay it from now on?

We've reached out to a few accounting firms and scanned the overall reactions from the various publications from the foreign chambers, and the overall opinion seems to be that companies should wait until further instructions will come out. This isn't legal advice, and strictly following the law is always the best and safest option, but if you or your company hasn't been paying it so far, you might be okay with just sitting back and waiting. After all, nothing has changed, no new law or order has been issued, simply a 13-year-old city government order has silently expired.

Some say that if the Shanghai government wanted companies to actually pay it, they would have released more clear announcements and clarified the details. But all this is speculation, the only thing that's for sure is that everyone is worried and waiting for more details to come out.

How much will it cost to pay?

Here's a quick dive into how the system works. China's social security system includes 5 pillars called "Shihui Baoxian" (社会保险), often just called "Shibao" (社保) plus a housing fund called Gong Ji Jing (公积金), together they are called, "5 insurances and one fund" (五险一金).

Some of them are fully paid by the company, but some are split between the company and the employee. That is, of course, only relevant if you negotiated your salary as a gross salary (pre-tax). If your salary is a net salary, the company still needs to pay you the same amount as they've been paying you before, which means they'll pay both yours and their share:

So, the additional cost for the company is 27%, for the employee it's about 11%.

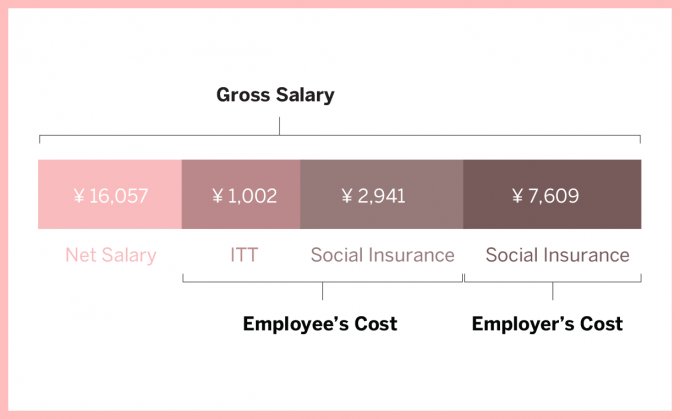

Let's do a quick calculation: Let's say your salary is a 20k gross salary. Without paying social security, the calculation would be this:

Pretty easy. Your gross salary is 20k. You pay 1.590rmb personal income tax and you end up receiving 18.410 net salary.

After it's this..

So, if foreign employees must contribute to social securities, a 20,000 RMB gross salary will received a reduced net salary of RMB 16,057, a reduction of around 12%. That's just your side. The cost for the company goes up way more by around 7k rmb, which means it's around 40% more expensive for a company to hire a foreign employee compared to before.

Will I be able to take the money out when I leave China?

Like with every social security system, parts of it work like an insurance. For the Health Insurance, you pay into it, and if you need to to visit a hospital, the insurance pays. This includes local hospitals only. They won't pay your bill at Parkway or Jiahui. You need to consult your HR for specifically how this works.

Same goes for the Work-Related Injury Insurance, which should continue paying you salary if you are unable to continue working due to an accident or related medical problem.

Then there's the Unemployment Insurance. Which is where problems arise for foreigners. For your Chinese colleagues, they have access to these funds for up to 2 years when they lose their jobs after having paid into this system for a few years. As a foreigner, losing your job means losing your visa. So this raises the question, why foreigners would want an unemployment insurance if technically you aren't able to be unemployed and live in China? This is a fine question. This is a fine question indeed.

The most complex element though is the Pension fund, which makes up for the biggest portion of the new fees. In theory, you should be able to get paid a pension once you retire if you've paid into the system for at least 15 years. Legal retirement age currently is 55 ( blue collar man), 50 (blue collar woman), 60 (white collar men) and 55 (white collar woman). However, China also doesn't issue visa to foreigners above that age, which means you can't actually retire in China. Technically, foreigners can apply to terminate their social insurance individual account upon written application before leaving China. The amount remaining in the individual account can be paid in a lump sum to the person.

I already pay Social Security in my home country:

China currently has bilateral agreements with 12 countries (the French one isn't imp) to make sure you don't have to pay 2 times into the social security system. That means if you are a citizen of any of these countries and already.

Need help with your companies tax or personal income tax. Browse SmartShanghai's accounting company directory here.